The average person believes they would never fall for a scam that would rob them of their life savings and their dignity, but the truth is that in San Diego County, deceptive schemes trick consumers into giving up banking, credit card information and other personal data every day, and it’s getting worse. Bad actors often use sophisticated methods to mimic legitimate businesses that consumers deal with regularly. Before you click on an unsolicited link that appears to be urgent, stop to think it through. You could be dealing with a scam.

Common phishing scams include:

A delivery notice purporting to be from Amazon, UPS or FedEx saying a delivery is late or can’t be made.

A utility shut-off message from SDG&E saying services are scheduled to be shut off.

A computer pop-up or email message saying your anti-virus subscription, such as McAfee, has expired and must be renewed today.

Pop-up ads purporting to be from Microsoft warning your computer has been hacked.

These scams trick innocent people into going to phony websites that look legitimate, leading unsuspecting victims to click on links that download malware and give access to private information. This could lead to extortion, identity theft and financial ruin.

Another relentless scam begins as a tech scam and quickly turns into a banking scam. Here are common ways this scam works:

It starts with bad actors sending phony Microsoft pop-up ads warning that the user’s computer has been hacked.

This quickly turns into a banking scam, with the same bad actor pretending to be from a financial institution.

They trick victims into believing their bank accounts have been compromised and they must pull out their money to keep it safe during the ‘investigation.’

Criminals convincing victims that their financial advisors are under investigation and cannot be trusted.

The victim is coaxed into giving their money to the fraudster for safekeeping.

The fraudsters warn the victim not to say anything or risk being harmed or going to jail.

In a local case that robbed a San Diego senior out of $200,000, the scammers were part of a transnational criminal network that use couriers to pick up money from victims. Several times a week, couriers come into San Diego County to collect funds from elderly victims who are scammed out of their life savings.

The criminal network uses ride share companies to pick up fraudulently obtained funds.

Couriers most commonly pick up money from victims and deliver it to another person in the network, or they convert the cash to cryptocurrency and send it out of the country. In most cases, once the money is sent by the victims, it cannot be recovered.

If you or a loved one receive a message prompting you to click on a link, stop. Do not click on unsolicited links and do no deal with the person sending the message. Instead, directly contact your financial institution or the company the bad actor may be impersonating.

Don’t click, call or answer if:

You get a phone call you didn’t expect saying there is a problem with your computer.

You get a message that a foreign spammer attacked your system and you need to pay to protect your banking information.

If you are asked to make payment in Bitcoin or wire transfer, it is a scam.

Never, under any circumstances allow anyone to install remote access software onto your computer or device.

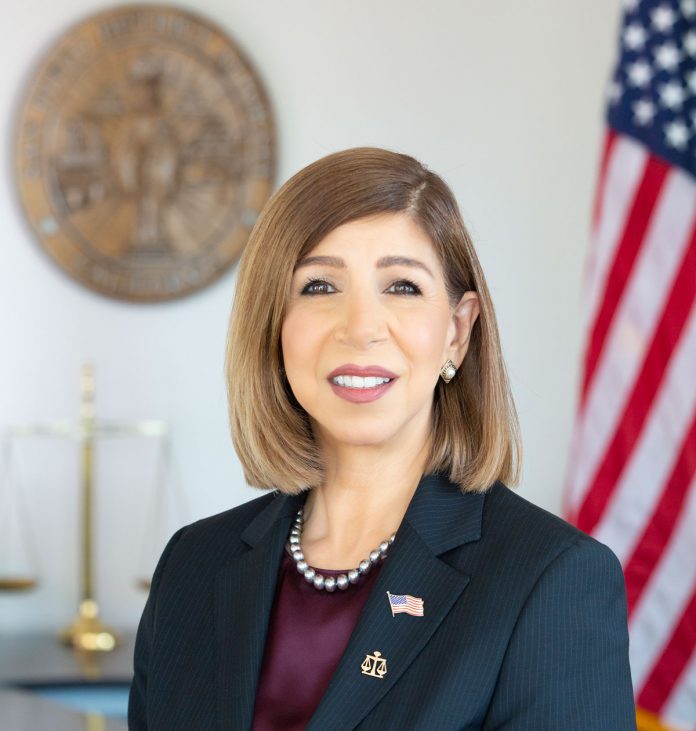

The DA’s Consumer Protection Unit is comprised of Deputy District Attorneys, Investigators and Paralegals dedicated to protecting consumers and law-abiding businesses from fraudulent or unfair business practices. To report a consumer complaint, you can call (619) 531-3507 or email consumer@sdcda.org. If you have been the victim of elder abuse, report it to Adult Protective Services: (800) 339-4661.